bank owned life insurance tax treatment

Ad Shop The Best Rates From National Providers. Bank-owned life insurance is a type of life insurance bought by banks as a tax shelter leveraging tax-free savings provisions to fund employee benefits.

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

Understanding Taxes On Life Insurance Premiums

Bank Owned Life Insurance BOLI is an excellent vehicle for financing the cost of employee benefits.

:max_bytes(150000):strip_icc()/HowDoesLifeInsuranceWork-dd125debc30e4f48bd805fdb13fc98b9.jpg)

. Executive Benefits Network has helped. ASC 325-30-25 states that a third-party investor should account for its investments in life settlement contracts using either the investment method or fair-value. A bank will purchase and own a life insurance policy on an executive or group of executives lives and the bank is listed as the beneficiary of the policy.

5000 Life Insurance income account. Federal Income Tax Treatment of Life Insurance. Since the 1980s banks have purchased bank-owned life insurance or BOLI for various business purposes most commonly to recover losses associated with the death of a key person to recover the cost of providing pre-.

The new section limits the amount of tax-free treatment a person which can be any type of entity can. 2022 Reviews Trusted by 45000000. Reviews Trusted by 45000000.

The tool is designed for taxpayers who were US. The face amount of the policy if specified in the policy. The bank pays for the coverage and is the beneficiary after the insured persons death.

Tax treatment is changed existing plans may be grandfathered. Life Insurance premium expense account. A Primer for Community Banks by Cynthia L.

One of the following exceptions must be met for the benefits to be tax-free. However if existing policies are not grandfathered they may be surrendered for their cash surrender values. BOLI may offset the current and future costs of pre- and post-retirement medical coverage group life retirement and many other benefits offered to bank employees.

For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. See Your Rate and Apply Online. Ad Compare the Best Life Insurance Providers.

In addition Bank Owned Life Insurance is a highly effective financing tool and. Taxpayer qualifies as a bank within the. In general proceeds from life insurance policies are tax free under the general exception rules in Sec.

The Most Reliable Life Insurance Companies That Will Actually Cover Your Loved Ones. Bank Owned Life Insurance BOLI is the predominant investment asset for financing the cost of employee benefit plans. Life insurance is one of the few assets that receives preferential treatment for tax purposes.

Cash surrender values grow tax-deferred providing the bank with monthly bookable income. 3200 Conclusion The use of Life Insurance may be a key financial decision for your business. However The Pension Protection Act of 2006 enacted important statutory changes to the general rule for employer-owned life insurance contracts stating that death benefits received.

Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs. 101 j 1 was added with the enactment of the Pension Protection Act of 2006 PL. Ad Get Instantly Matched with Your Ideal Life Insurance Plan.

The bank purchases and owns an insurance policy on an executives life and is the beneficiary. Course CPA Principal Federal Reserve Bank of San Francisco. Upon the executives death tax-free death benefits are paid.

Easy Online Application with No Medical Exam Required Just Health and Other Information. In the past money received through a life insurance contract paid by reason of the death of the insured were generally not includable in gross income for federal tax purposes. The sweeping Tax Cuts and Jobs Act TCJA signed into law in late 2017 includes a provision that appears to apply to bank-owned life insurance BOLI which often is used as a tax-free investment for banks sometimes but not always coupled with an employee benefit program.

This general rule changed when Sec. Corporate Owned Life Insurance COLI owned by banks is often referred to as Bank Owned Life Insurance or BOLI. There are important distinctions however in how this term BOLI may be used that should be understood.

FACTS Taxpayer is a national banking association and is wholly owned by Parent a holding company and bank holding company. If the tax treatment is changed existing plans may be grandfathered. However if they may be surrendered for their cash surrender values.

An employer-owned life insurance policy includes policies where a business is the owner the business is the beneficiary and the employee is the insured. 101 N Cascade Ave 10 Colorado Springs CO 80903. BOLI is a tax-efficient tool often used to offset the cost of an employee benefit program making it easier for banks to.

Bank-owned life insurance BOLI is a type of permanent life insurance policy banks buy for high-salaried employees or board members. Bank Owned Life Insurance. Bank Owned Life Insurance BOLI uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions.

Rulings concerning the federal income tax consequences regarding the recognition of a loss on the surrender of bank owned life insurance BOLI submitted by Taxpayer. Citizens or resident aliens for the entire tax year for which. Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy.

The tax treatment of proceeds paid on the death of the insured is unaffected by the fact that the contract is a MEC. The new section limits the amount of tax-free treatment a person which can be any type of entity can receive from the proceeds on an. The new provision could have unintended consequences for bank mergers and.

SelectQuote Rated 1 Term Life Sales Agency. The accounting for investments in life settlement contracts differs from the accounting by the original purchasers of life insurance. IRC 101j applies to employer-owned life insurance policies issued after August 7 2006.

5121 Accounting for life settlement contracts. Cash surrender values are allowed to grow tax. Over the past 1015 years however proposals to subject the inside build-up or death benefits of life insurance to income taxation have been raised by members of Congress and the Treasury as a means.

If you are receiving the proceeds in installments whether there is a refund or period-certain guarantee. Bank Owned Life Insurance BOLI Bank Owned Life Insurance BOLI is defined as a company owned insurance policy on one or more of its key employees. If federal income tax was withheld from the life insurance proceeds.

Bank Owned Life Insurance BOLI uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions. Ad Valuable Term Coverage from 10000 to 150000. 2022s Top Life Insurance Providers.

Boli Explained Paradigm Life Blog Post

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Key Man Life Insurance What Is It How Does It Work 2022

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

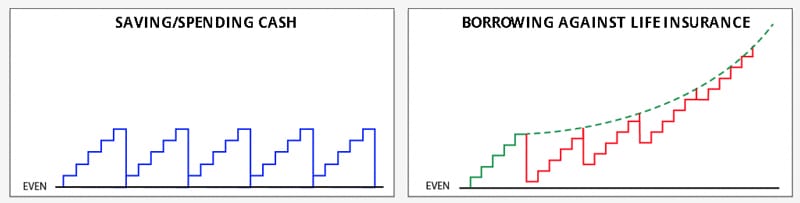

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Loans A Risky Way To Bank On Yourself

Corporate Owned Life Insurance Everything You Must Know

Tax Deductible Life Insurance Business Owners

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

:max_bytes(150000):strip_icc()/HowDoesLifeInsuranceWork-dd125debc30e4f48bd805fdb13fc98b9.jpg)

Life Insurance Companies Policies Benefits And More

Private Family Banking System With Whole Life Insurance Paradigm Life

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

Life Insurance Loans A Risky Way To Bank On Yourself

Boli Explained Paradigm Life Blog Post

Boli Explained Paradigm Life Blog Post

Life Insurance Policy Loans Tax Rules And Risks

Common Mistakes In Life Insurance Arrangements

Understanding Life Insurance Policy Ownership The American College Of Trust And Estate Counsel